Comparison of UK Benefits with those of the EU14

9 December, 2012

Summary

1. In-work benefits for the low paid are generous in the UK compared to other countries in the EU15 and may act as a much stronger pull factor towards Britain than to other member states. This paper finds that the UK is the fourth most generous country of the EU15[1] in its provision of benefits to low income workers after Denmark, Luxembourg and Ireland – with populations of 5.5 million, 500,000 and 4.5 million respectively. Furthermore, the UK is more generous than Finland and France and much more generous than Germany, Sweden the Netherlands and the rest of the EU14 in topping up low wages. When the costs of living are accounted for, low paid workers in the UK are the second richest in the EU15 after Luxembourg. Access to unemployment benefit, while paid at a lower rate than in many of the EU15 countries, is much easier to access in the UK where there are virtually no conditions of access, compared to more robust controls elsewhere.

Scenarios

2. Two scenarios will be examined. The first is a family made up of a worker, a spouse and two children where one adult is in work earning 50 percent of the average wage and the other adult is not working and not drawing unemployment benefits. The second scenario is a similar family where the sole earner is now unemployed.

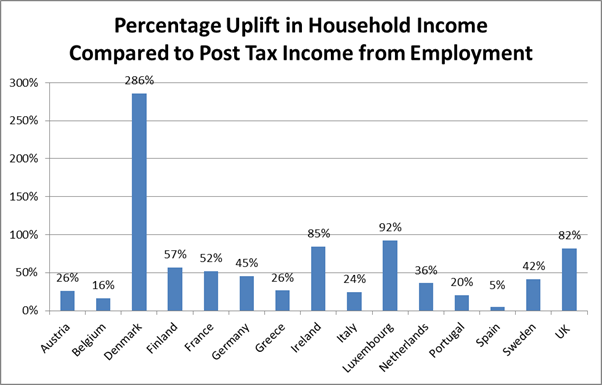

Welfare Provision in the United Kingdom

3. Low income earners in the UK have their income topped up by a range of in-work benefits and other benefit payments designed to help low income families with the costs of housing and maintaining a family. In scenario one, an individual earning 50 percent of the average wage – a relatively low wage – will have a gross pay of £17,150. After a deduction of £2,135 in income tax and £1,258 in National Insurance (NI), this family is left with £13,755[2]. The family will then receive £3,952 in housing benefit, £6,897 in family related benefits as well as £416 of in-work benefit. The total net take home income is therefore £25,022[3]. That is an 82 percent increase on the post-tax pay.

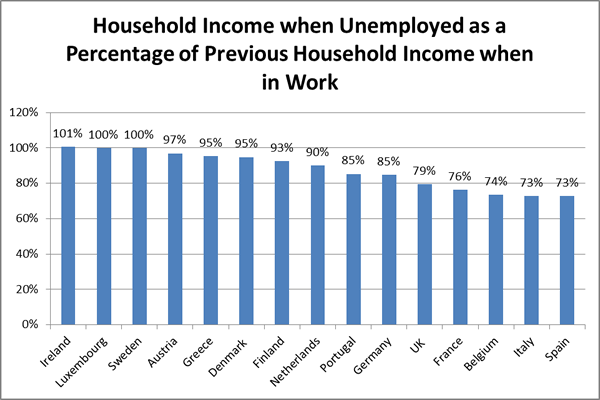

4. In scenario two where the sole breadwinner is now unemployed, the family would be wholly reliant on the benefits system for income. They would receive £5,343 in unemployment benefit which is not particularly generous compared to some EU countries. However, they also receive a number of other benefits - £7,639 in housing benefit and £6,897 in family related benefits. Their total income in this scenario would be £19,880, which is 79% of the total household income when the sole earner was in work.

Welfare Provision in the UK compared to the EU14

5. It is possible to calculate the tax deducted and benefit provided in these two scenarios in the rest of the EU15. The EU 15 has been selected for comparison, on the basis that citizens of the A8 and A2 countries are likely to be the ones migrating towards the wealthier west. Cyprus and Malta are excluded from this study.

6. In scenario one, only in three other countries would there be a greater difference between the income after tax and the final household income inclusive of benefits – in Denmark, Luxembourg and Ireland. In Denmark the final household income is 286% higher than the post-tax income, in Luxembourg that figure is 92% higher, while in Ireland it is 85% higher. The UK is thus the fourth most generous state for low earners - see Annex A for a full table of results. (In the UK the uplift for even lower paid workers is much higher; on the current minimum wage of £6.19, an individual with a spouse and two children would have a final take home pay 182 percent higher than his or her post-tax earnings)[4].

Figure 1. The difference between income after tax and final household income, i.e. inclusive of benefits , based on earnings that are 50 percent of the average wage in each country. Source: OECD

7. Unemployment nearly always reduces the household income of a family. The issue is the extent to which individuals are worse off unemployed than they were when working. In scenario two, only in Ireland are individuals better off unemployed than in work in terms of their household income. An individual in Ireland would have a total household income of €29,370 while unemployed, a one percent increase on his or her total household income during employment. In Luxembourg and Sweden individuals receive the exact same amount in benefits when unemployed as they received in income and benefits during employment. In all other countries, an individual is worse off unemployed than in work, ranging from 3 percent worse off in Austria to 27 percent worse off in Spain. In the UK an individual would lose 21% of his or her household income when unemployed. (See Annex B for a full table of results)

Figure 2. Total Household Income when Unemployed as a Percentage of Previous Household Income when in Work. Source: OECD

Value of Welfare Provision across the EU15

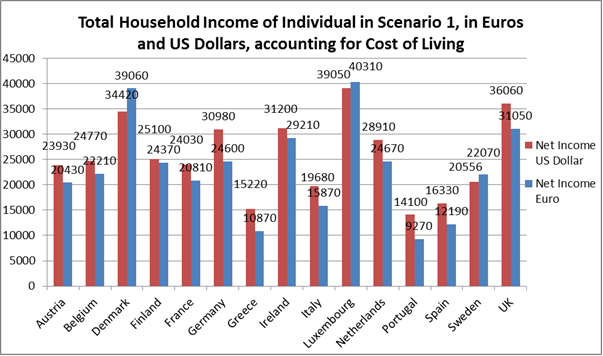

8. Raw numbers only provide part of the picture since the cost of living varies widely between countries. There is, however, a means of accounting for the different costs of living by using Purchasing Price Parity data which is expressed in US Dollars. Income can be converted into US Dollars and then directly compared.

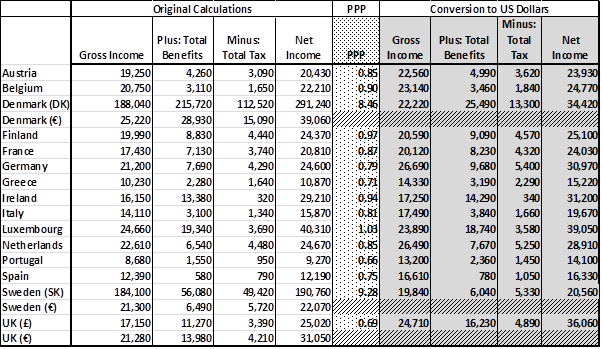

9. The results show that, when the costs of living are accounted for, workers in the UK who are on 50 percent of the average wage and who have their income topped up through in-work benefits are the second richest in Europe, after Luxembourg. On this basis their pay would be equivalent to $36,000 pa compared to $39,000 in Luxembourg and $34,400 in Denmark. Ireland comes in at $31,200, Germany at just under $31,000, Netherlands at just under $29,000, Finland at $25,100, and France at $24,000. Individuals are worst off comparatively speaking in Greece and Portugal where pay is worth the equivalent of $15,200 and $14,100 respectively (See Annex C for the full data)

Figure 3. Total Household Income of Individual in Scenario 1 (Individual with Spouse and Two Children Earning 50 percent of the Average Wage), in Euros, and in US Dollars, accounting for Costs of Living (using PPP Data).

Ease of Access to Unemployment Benefit in the EU15

10. There is a significant difference between the UK and the rest of the EU15 in the accessibility of unemployment benefit. In other countries unemployment benefit is conditional on social insurance contributions and the amount paid out is linked to previous earnings. Moreover, the length of time that unemployment benefit can be claimed is linked to the length of time previously in work.

11. For example in every other EU15 country an individual can only claim unemployment benefit when they have worked for a specific amount of time and thus contributed to the system or made a certain number of social security payments. This ranges from 4 months in France to one year in many countries, including Austria, Denmark, Germany, Italy, and Spain. In Portugal an individual has to have worked for at least 450 days in the previous 24 months. All other countries require a certain number of payments or that a certain number of days/weeks/months be worked before an individual qualifies for unemployment benefit. The level of benefit paid is generally linked to previous earnings and often capped at an upper limit – only in Ireland and Finland is unemployment benefit paid at a flat rate. Moreover, in all countries except Belgium, unemployment benefit is paid for a period of time related to the amount of time previously spent in employment or it is capped for a period ranging from a few months to a maximum of 38 months in the Netherlands; it is capped at two years in Denmark, France, Portugal and Spain. In Belgium it can be claimed for an indeterminate period of time.

12. This contrasts sharply with the UK where there are two types of unemployment benefit available to job seekers. Contribution-based Job Seekers Allowance (JSA) is conditional, at least in theory, on actively seeking work, and Jobcentre staff regularly monitor claimants to see what they are doing to find work, with sanctions being applied if they do not. Contribution-based JSA is based on NI contributions and capped at six months. However, if you do not qualify for contribution-based JSA as you have not previously worked then you are able to claim income-based JSA – also conditional on actively seeking work – but not conditional on previous NI contributions, therefore payable to someone even if they have never worked. There is no time limit on income-based JSA and it is paid at a rate unrelated to previous earnings.[5] (See Annex D). These two benefits (Income and Contributions-based JSA) are paid at the same rate therefore a worker is not penalised for never having contributed anything in tax or NI.

13. EU rules permit social security contributions made in one country to be ‘transferred’ when claiming unemployment benefit in another country. However, since the UK has no minimum contribution requirement for income-based JSA, and the payment is related neither to previous earnings nor to the length of time that has been worked, an unemployed worker would be able to claim unemployment benefit on much more favourable terms than in the rest of the EU15 where the benefit is more strictly governed.

14. In short, it is far easier to gain access to unemployment benefits in the UK than anywhere else in the EU15.

Conclusion

15. The UK is far more generous than most other EU15 countries in topping-up low wages by just over 80% through in-work and housing benefits. This makes employment in the UK a very attractive for migrants from less wealthy EU member states, especially after adjusting for differences in the cost of living.

16. Access to unemployment benefit is also much easier than in other EU countries.

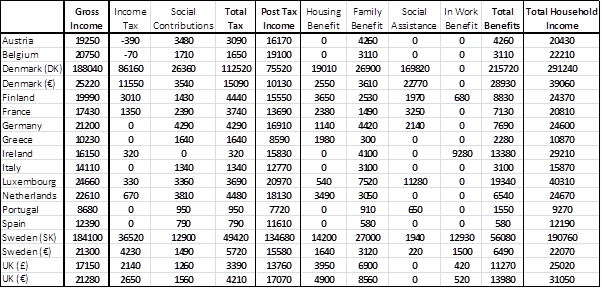

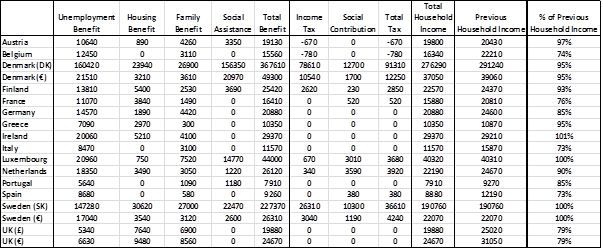

Annex A

Annex B

Annex C

Annex D

|

Minimum Contribution |

Benefit Rate linked to Earnings/Contributions |

Length of Payment linked to Length of Employment |

Austria |

Yes. Workers must have been covered by compulsory unemployment insurance for 52 weeks of the previous 24 months (26 weeks of previous 12 months if under 25) |

Yes. Benefit is paid at 55% of average earnings of last complete calendar year, capped at €3,930 per month. |

Yes. Benefit is paid for 20 weeks, rising to 30 weeks for 3 years insurance in previous 5 years, 39 weeks for 6 years insurance in previous 10 years and 52 weeks for 9 years insurance of previous 15 years if at least 50 years old. |

Belgium |

Yes. Workers must have worked between 312 and 624 days in a 18-36 month period depending upon age. Must have become unemployed in Belgium. |

Yes. Benefit is paid at a rate of 60% of previous earnings with a maximum and minimum cap. |

No. Unemployment Benefit is not linked to previous length of employment nor is it capped. |

Denmark |

Yes. Workers must have at least one year’s membership of compulsory unemployment insurance and must have worked full time for 52 weeks of the last 3 years. |

Yes. Benefit is paid at a rate of 90% of previous, capped at €513 per week. |

Yes. Benefit is paid for two years within a three years period, at which point entitlement must be proved again. |

Finland |

Yes. Workers must have been working for 34 weeks in the previous 28 months. |

Basic allowance is paid at a flat rate of €25.74 per day. Earnings related allowances increase the basic allowance by 45% of the difference between previous daily wage and basic allowance. |

Yes. Benefit is paid for a maximum of 500 working days (benefit is paid 5 days a week). |

France |

Yes. Workers must have worked for a minimum of 4 months |

Yes. Benefit paid at 75% of previous earnings if less that €1090, or equivalent salary of either 40% plus €12 or 57% of daily rate of pay |

Yes. A worker who has worked for 4 months is entitled to a maximum of 24 months of benefit provision |

Germany |

Yes. Workers must have been in employment and social contributions paid for at least 12 of the previous 24 months |

Yes. Benefit is paid at 60% of previous earnings (67% for those with dependent children). |

Yes. Duration ranges from six months for those who have contributed 12 months up to a maximum of 24 months. |

Greece |

Yes. Workers must have 125 unemployment insurance days’ payments in the previous 14 months, excluding the two months preceding unemployment. |

Yes. Benefit is paid at 50% of previous pay (with a minimum) increased by ten percent for each dependent family member. |

Yes. 125 days insurance payment provides 5 months benefit, 150 days provides 6 months, 180 days provides 8 months, 220 days provides ten months and 250 days provides twelve months. |

Italy |

Yes. Workers must have paid 52 weeks of social contributions in the previous two years |

Yes. Benefit is paid at a rate of 40% of person’s pay in the preceding three months with a limit of €1,073 per month. |

No. Duration of provision is not related to length of time previously in work, however is capped at 240 days for those under 50 and 360 days for those over 50. |

Ireland |

Yes. A worker must have paid 104 weeks of social insurance contributions and paid/credited 39 weeks in the relevant year. |

No. Unemployment benefit is paid at a flat rate of €196 per week. |

Yes. For those with less than 260 weeks of social contributions benefit may be claimed for up to 234 days. For those with more, benefit can be claimed for up to 312 days. |

Luxembourg |

Yes. A worker must have been in employment for 26 weeks in the year previous to unemployment. |

Yes. Unemployment benefit is paid at a rate of 80% of previous earnings and 85% for people with dependent children. It is capped however at two and a half times the minimum wage for the first 6 months and twice the minimum wage for the next 6 months. |

Yes. Unemployment benefit is paid for the equivalent number of months that the claimant worked in the previous 12 months. It is capped at 12 months in any 24 month period. |

Netherlands |

Yes. A worker must have been in employment for at least 26 of the 36 weeks preceding unemployment. |

Yes. Benefit is paid at a rate of 75% of previous earnings (although capped) for two months and 70% thereafter. |

Yes. If you have worked 26 out of the preceding 36 weeks then benefit can be claimed for 3 months. It is capped at 38 months for those that qualify. |

Portugal |

Yes. Workers must have worked at least 450 days in the previous 24 months. |

Yes. Benefit is paid at a rate of 65% of previous earnings, with minimum and maximum rates. |

Yes. The length of time benefit is paid corresponds to the age of the claimant and time they have been in work. It is capped at 24 months. |

Spain |

Yes. Workers must have paid 360 days’ worth of social contributions in the six years prior to unemployment. |

Yes. Benefit is paid at a rate of 70% of the average earnings in the previous six months for the first 180 days, after which benefit is paid at a rate of 60%. |

Yes. A worker who has contributed between 360 and 539 days of social contributions is entitled to 120 days of benefit. The maximum time that can be claimed is 2 years for people who have contributed almost six years or above. |

Sweden |

Yes. Workers must have been affiliated to an unemployment fund for at least 12 months or have worked for a minimum of 6 months, or 480 hours during a continuous six month period during the previous 12 months. |

Yes. Unemployment benefit is paid at a rate of 80% of income before unemployment during the first 200 days and 70% thereafter. For those who satisfy the work requirement but not the membership requirement then benefit payment is paid at €35 per day. |

Yes. Unemployment benefit is paid for a maximum of 300 days. Those with dependent children are entitled to an additional 150 days. |

UK |

No. Income-based Job Seekers Allowance (JSA) is payable to anyone regardless of whether they have previously worked |

No. Income-based JSA is paid at a flat rate of up to £56.25 for those under 25 and up to £71 for those aged 25 and over. |

No. There is no time limit on the duration which income-based JSA can be claimed. |

References

OECD Tax Benefit Calculator, URL: http://www.oecd.org/social/socialpoliciesanddata/benefitsandwagestax-benefitcalculator.htm

Information on conditions of receipt of unemployment benefit taken from European Commission documents, ‘Your Social Security Rights in …’ produced in 2011 and which can be found here, URL: http://ec.europa.eu/social/main.jsp?langId=en&catId=858.

OECD, 2011 PPP Data for Actual Individual Consumption, URL: http://stats.oecd.org/Index.aspx?datasetcode=SNA_TABLE4

UK Government Online, ‘Jobseeker’s Allowance’, URL: https://www.gov.uk/jobseekers-allowance

Notes

OECD

OECD Data is from 2010 and is the latest available.

Exchange Rates, OANDA:

1GBP = 1.2441 EUR (As at 23-11-2012)

1SEK = 0.1157 EUR (As at 29-11-2012)

1DKK – 0.1341 EUR (As at 01-12-2012)

Purchasing Power Parity

Purchasing Power Parity (PPP) data adjusts for the differing costs of living in two countries which simple exchange rate mechanisms cannot account for. PPP therefore compares household incomes in different countries after taking account of the different costs of living.

Footnotes

- The EU15 is the pre-2004 European Union. It consists of Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden and the United Kingdom. It does not include the A8 countries of the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia which joined in 2004, or Malta and Cyprus which also joined in 2004. It also excludes the A2 countries of Bulgaria and Romania which joined in 2007.

- Numbers may not add up due to rounding.

- OECD, Tax Benefit-Calculator, URL: http://www.oecd.org/social/socialpoliciesanddata/benefitsandwagestax-benefitcalculator.htm All other calculations are also derived from OECD data unless otherwise stated.

- See Department for Work and Pensions Tax Benefit Models, URL: http://statistics.dwp.gov.uk/asd/index.php?page=tbmt. An individual with a spouse and two children on the minimum wage would have an annual post tax income of £10,137. After Working Tax Credits, Child Tax Credits, Child Benefit, Housing Benefit and Council Tax Benefit the family would have an annual income of £28,603, an increase of £18,466, or 182 percent. It was not possible to calculate or compare minimum wage earnings across the EU as the OECD does not have the data.

- Job Seekers Allowance, Gov.uk, URL: https://www.gov.uk/jobseekers-allowance/what-youll-get

- The EU15 is the pre-2004 European Union. It consists of Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden and the United Kingdom. It does not include the A8 countries of the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia which joined in 2004, or Malta and Cyprus which also joined in 2004. It also excludes the A2 countries of Bulgaria and Romania which joined in 2007.

- Numbers may not add up due to rounding.

- OECD, Tax Benefit-Calculator, URL: http://www.oecd.org/social/socialpoliciesanddata/benefitsandwagestax-benefitcalculator.htm All other calculations are also derived from OECD data unless otherwise stated.

- See Department for Work and Pensions Tax Benefit Models, URL: http://statistics.dwp.gov.uk/asd/index.php?page=tbmt. An individual with a spouse and two children on the minimum wage would have an annual post tax income of £10,137. After Working Tax Credits, Child Tax Credits, Child Benefit, Housing Benefit and Council Tax Benefit the family would have an annual income of £28,603, an increase of £18,466, or 182 percent. It was not possible to calculate or compare minimum wage earnings across the EU as the OECD does not have the data.

- Job Seekers Allowance, Gov.uk, URL: https://www.gov.uk/jobseekers-allowance/what-youll-get